Payday loans can be stressful and keeping up with repayments can be tough. This is why you should only borrow what you need, and what you can afford to repay. Borrowing more than this can get you in trouble.

There are a few techniques you can use to get on top of debt and make repayments on time. If you can meet all of your repayments this should reduce your stress levels and help you with loans in the future.

In this guide, we will cover some of the top ideas about how to make your repayments easier.

Debt Repayment Top Tips

- Staying on top of your repayments is key to maintaining a good credit score.

- Making your monthly repayments will help you borrow more money in future if you need to.

- Plan your monthly expenditure with a budgeting app.

- 14% of US borrowers actually make their repayments on time

Set Aside Money To Make Your Repayments

Repaying debts is never fun – especially when your budget might already be stretched. It is important to make sure that you have enough money left over in your budget to pay back what you owe for any loans or payday loans. If you cannot repay on time you might be charged late fees, or the interest on the loan could increase. Either way, it will cost you more money which could make it even more difficult to pay back this money on time.

A good rule is to immediately put aside the money you need for repayments when you get paid. If you can put it in another account or physically hide the cash somewhere else, it will help you resist spending it. You can do this for debt repayments, but you can also do it for gas, electricity, and other bills to make sure you can stay on top of them.

Create A Budget That Works For You – And Stay On Track

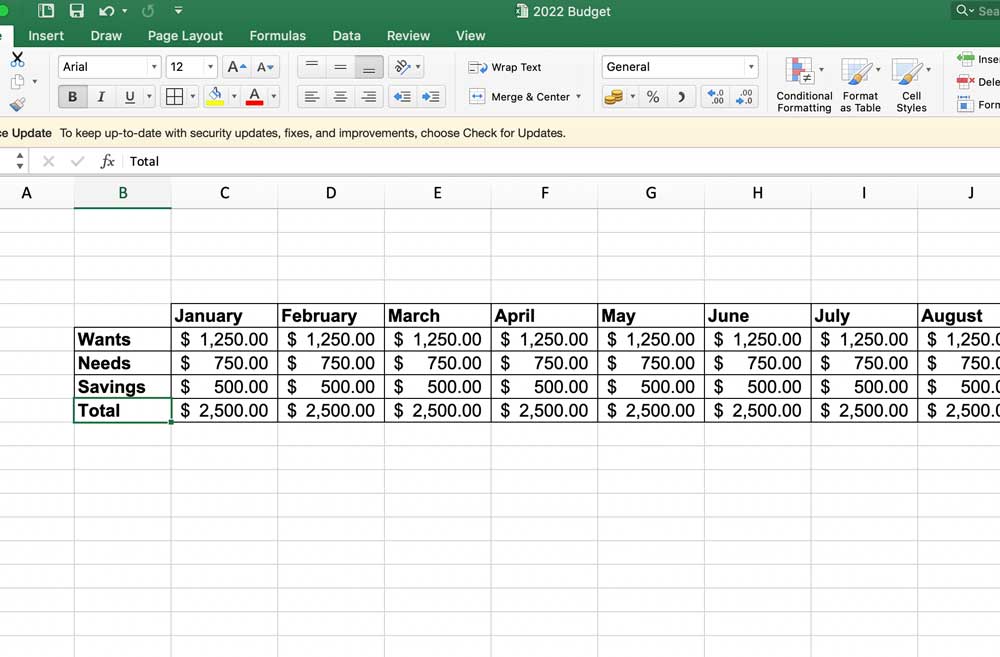

There are a huge number of budgets that you can follow but the most important thing is to choose one that you are actually going to follow. There is no point in having the world’s best budget that you then just go off track in the first month.

There are simple budgeting templates available that will help you get started. You could even use a pen and paper to start – whatever helps you get going. The key is to actually start using the system that you have created instead of letting it live on in theory.

Budgeting can seem tiresome but over the long run, it can help you stay on top of your financial health.

Simple budgets can be better than complex budgets. The key is to create something that you can stick to.

The 50/30/20 Rule Is A Good Place To Start

If you’re not sure which budget to start with the 50/30/20 rule of budgeting is an easy place to start. It works very simply – when you get your paycheck you will divide it up – 50% for things you need (rent, bill etc), 30% for things that are non-essential that you want, and 20% is for savings and debt repayments.

That 20% is key to helping you stay on track with any emergency spending that you have to do.

Cut Out Non-Essentials

If you have started budgeting and still find it difficult to save money each month then you might need to cut out non-essential expenditures. You might find this difficult if you have struggled with debts in the past.

Look at every bill and outgoing that you spend money on each month. What can you live without and could be deemed a luxury? This doesn’t have to be forever, it could just be until you pay back your debts. Looking at it this way makes it easier to stomach – once you are on top of your budget again you could start buying this thing again.

If you can cut back then your route to paying back your payday loan can be closer than ever.

There is a big difference between what you need and what you want. See if you can cut back on the non-essentials for a month.

What Other Options Are There?

If you’ve budgeted and cut out non-essentials there are a few more things that you can do.

Change Your Repayment Terms

If you are looking for help to repay your payday loan then you could talk to the lender. In some situations, they will extend your repayment terms which could give you more time to repay your debt.

Generally, if you follow an extended payment plan then it will give you four extra pay dates to pay back the loan. If you continue to make your repayments then you won’t be handed over to the collection agency.

See If Your Employer Will Give You A Cash Advance

Depending on who you work for some cash advance companies can help their employees with money upfront from a paycheck. If they know you well and have been working together for a while then they might be willing to help.

If you know that you’ll be making extra repayments on a loan in a certain month then make sure you have budgeted accordingly for the reduction in available money that month.

Can Your Family And Friends Help Out?

One final option is to ask family and close friends if they’d be able to help out that month. It is sometimes a good option if you know that you’ll be able to repay the money quickly.

Nothing damages family and friends relationships like money. Be careful about how much you want to borrow and over what time period. Draft up a contract that lays this out so that there is no confusion about when and how much money you’ll be paying back.