If you have decided to track your monthly expenses in a spreadsheet instead of an app then using a free budgeting template or spreadsheet might help you get started quicker than making your own.

We have suggested five templates below that we believe will help you on your budgeting journey. Like with everything, if you can reduce friction when you start a new habit it will help you get started. Before you download anything online make sure that you have read reviews and that the website is from a credible source. This can help you avoid viruses and phishing.

The FTC (Federal Trade Commission’s) Budgeting Worksheet

How does it work? The FTC provides a full service on its website to educate Americans about money, how to use it and how to budget. If you go to their “Make a Budget” worksheet you will be able to download a PDF copy. Save a copy onto your desktop and then follow the instructions to fill in all the fields to calculate whether you’re spending more or less than your monthly net income.

Why Capital Bean likes it. Complexity can stop progress. When you’re looking at some budgeting spreadsheets then you might immediately close them down because of the formulas and cells. This sheet is the furthest thing from complicated and allows you to get started immediately. It is a good way to get a snapshot of your cash flow. You could use a more complicated spreadsheet after this but it is a good place to start.

Where can I find it? Visit www.consumer.gov and you can find the PDF from the tab labeled “Toolbox”.

Budgeting doesn’t have to be rocket science. Use one of our simple straightforward budgeting templates to get started and get your finances in order.

Capital Bean’s Budget Worksheet

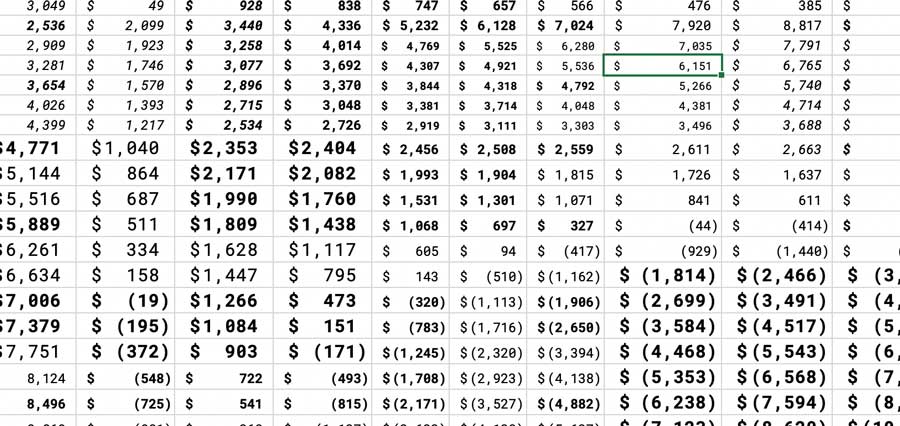

Use this downloadable budget sheet to put in your monthly expenses and income. After you have entered that information then you can see how your income is split into the 50/30/20 budget breakdown. This budget suggests that you should spend 50% of your net income on needs, 30% of your net income on wants, and then 20% on savings and any debt repayments.

Why We Like It: This incredibly thorough sheet asks you to consider a huge range of expenses that you might not think about. Anything from health insurance premiums to car insurance to minimum credit card payments. It’s been designed so you don’t miss anything.

Where Can I Get It? Capital Bean’s own downloadable resources.

Templates From Microsoft Office

How Does It Work: It is one thing to maintain a spreadsheet on a week-by-week basis – this is tough all by itself. But creating one from scratch also takes time. Instead of spending your time setting up the columns and rows and figuring out what each of the formulas should be, you can download a sheet from Excel. They have a range of templates that include vacation planning, household expenses, and even one to plan your next party or event.

What Do We Like About It: There are a huge range of templates. Anywhere from complex to simple and in-between. If you go to Excel online then you are able to collaborate with others in the same document – great for family budget planning.

Where Can I Find It: If you go to www.templates.office.com/ and click on Budgets you will find an excel template to download. Alternatively, you can log in to Microsoft and get it from your desktop browser through Office 365.

Google Drive Spreadsheets

How It Works: Google Drive has created sheets, docs and others that allow you to create folders and documents online and share them with family and friends. If you sign up you get 15GB of storage for free and if you then start to use Google Drive you might find that is not enough storage. If you open up Sheets then you will find some pre-made templates – anything from a monthly to an annual budget template.

Where Can I Find It: Visit www.google.com/sheets and then navigate to the template gallery. You will be able to find everything there.

How Else Can I Take Charge of My Budget?

If you’ve already researched your free budget templates and spreadsheets then you’re off to a great start in your budgeting journey. Managing your money becomes much easier once you have started budgeting. If you don’t like the options that we’ve suggested above then there are other ways to budget

Try an App: There are many apps that track and categorize your spending – find the best apps of 2022 here.

Budget calculator: If you want to figure out easily how much of your monthly income you need to save or spend then you can use our budget calculator.

Books: Go old school and read an expert-suggested book about budgeting.

Start at the beginning: If you think you’ve missed the basics of budgeting then you can go back to the beginning and read about how to use the envelope system, zero-based budgeting, or budgeting 101.