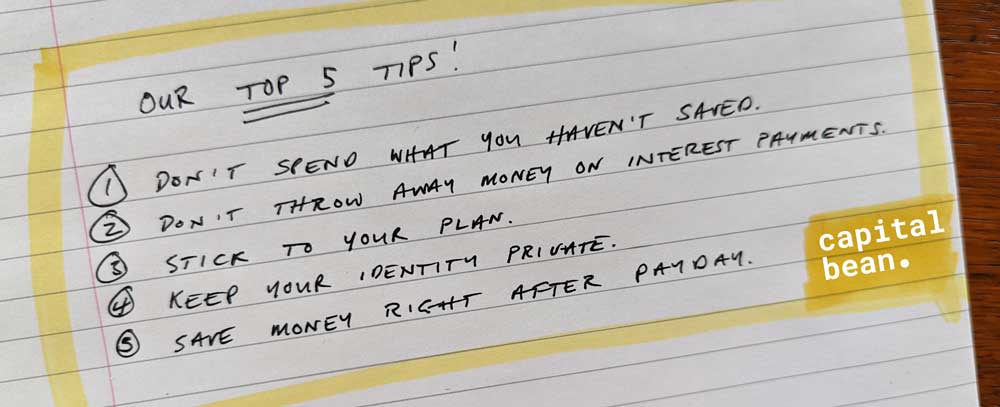

We know that the cost of living is going up – and the old saying goes – watch the pennies and the dollars will look after themselves. This is true in many situations and means that you can save money in a number of different ways. It might seem difficult at first but if you can change some habits then you’re on your way to reducing your monthly costs.

1. Don’t Spend What You Haven’t Saved

1. Don’t Spend What You Haven’t Saved

In our credit-consumed culture it is easy to put something on a credit card, or on an installment plan and then deal with the cost in the future. This can get you in financial difficulty as it means you will continue to build up debt that you are not paying off month to month. Capital Bean always talks about the 50/30/20 approach to budgeting and this is a key part of it. If you want to make a big (or small purchase) see if you can put the money aside for a couple of months first and then use it to pay for the item. Like reverse installments. But this way you don’t have to pay interest on the money you are saving. You might even make interest on it.

2. Don’t Throw Away Money On Interest Payments

Interest payments can get you further into debt. Especially toxic high-interest debt like credit cards or payday loans. It can drive you further into debt if you don’t get on top of it. Don’t worry if you can’t get on top of it all at once – there are approaches you can take to help out. One way is the avalanche method – paying off the debt with the highest interest first. The other is the snowball method – paying off the lowest amount first then rolling that money into the next biggest debt and so on and so forth. Whichever method you choose, create a plan and stick with it.

You could also look at transferring your debt on to an interest-free credit card so that you can avoid paying any credit card debt for a set period of time. When transferring you will sometimes face small balance transfer fees so make sure that transferring makes sense. A final step is to set up a direct debit so that you don’t miss any payments which could damage your credit score.

3. Stick To Your Plan

Make sure that you know what you’re trying to do each month, make a financial plan, and then stick to it. After you’ve created your budget you should have a good idea of how much money is going into each of the 50/30/20 buckets (needs/wants/savings). This means you could set up an automatic transfer each month that moves a certain percentage of your paycheck into a different pot or account.

Make payments right when you get your paycheck to avoid the temptation of spending.

4. Keep Your Identity Private

Browsers are very good at tracking your movement around the internet. You’ll have noticed this when shopping online for something that changes price often – think flights. You use a comparison website to book a flight and find the one you want. You spend your time doing something else and when you come back to the website the price has gone up by $50. This is because you’re being tracked to see what you’re interested in – the more you search the more that you want that product.

To reduce tracking online you can enable the incognito setting. This gives you a higher chance of finding good deals when you are searching online.

5. Don’t Spend All Of Your Money When You Get Paid

Spending money as soon as you get it is behavioral and psychological. You have lots of money so you spend it. Fortunately, there are some simple systems that you can set up that to avoid this. Setting up a direct transfer the day after you get paid is an easy system to implement. For example – set your saving goal each month. If it is $100 then set up an automatic transfer of $100 the day after you get paid. Straight into your savings account. No willpower is needed.