When you make a financial plan it will give you a full and comprehensive idea of your current finances, your goals, and then the strategies that you’ve set out to reach those goals. If you have made a good financial plan you’ll include details about your income, target retirement age, savings goals, debts, and investments. Basically, anything that makes up your financial picture.

What Is Financial Planning?

Financial planning is not something that you just do once and leave, it is a continual process that will reduce your stress and anxiety around money, support your current goals and needs and help you build up a financial cushion for retirement and any other unexpected expenses. Planning is important because it allows you to maximize the assets and money that you have and helps you hit future goals.

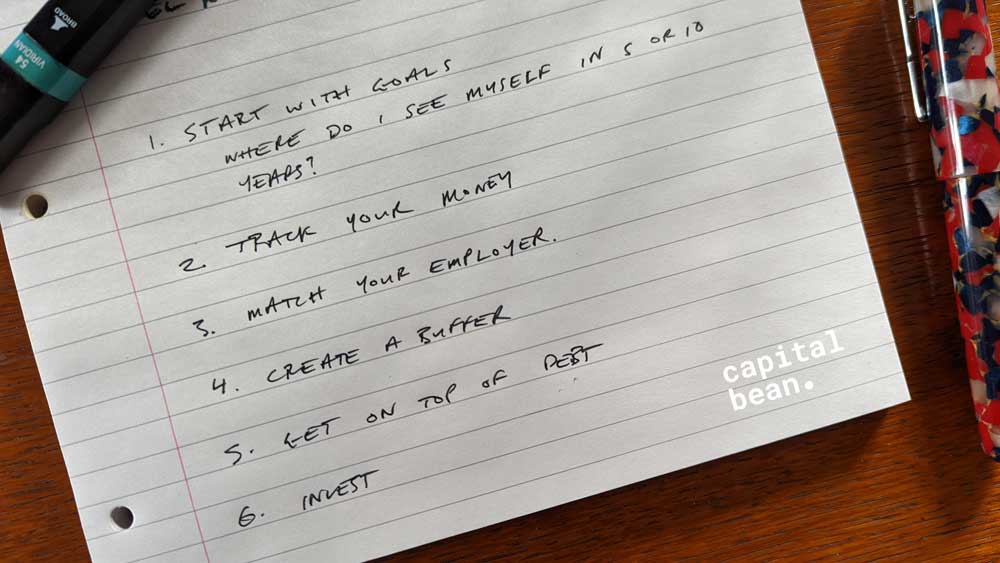

How To Financial Plan In 7 Simple Steps

1. Start With Your Goals

For any good plan you need to start at the end – what are your financial goals? If you start at the end it will mean that your financial planning will feel more deliberate because you are looking at what your money can do for you. And therefore every action that you take is aligned towards helping you achieve that goal.

Financial planning can seem like a boring topic – money is not always the most fun thing to think about. But if you think of your financial goals as aspirational it can help you build the future that you’re looking for. What do you want your life to look like in 5 and 10 years – what are you doing, how much money do you have saved, do you have a house?

If you start with your goals it can help put into context why you are saving money each month. If you don’t have goals it might be difficult to stick to your plans each month.

2. Find A Way To Track Your Money And Direct It Where You Need It

After you have set your goals you can then try and get an accurate picture of how your money is flowing each month. What comes in and what goes out each month. Getting an accurate view of your cash flow will help you figure out what needs to be changed and what is going well. Once you can see where your money is going you can see what you need to do to redirect the money for short, medium, and long-term goals.

Developing some sort of budget is usually the first way to create a plan. We always talk about the 50/30/20 approach to budgeting. With this budget, you will put 50% of your monthly take-home pay towards everything that you need (housing, bills, transport to work, and other recurring bills). 30% is towards what you want (clothing, eating out, going to a bar, traveling for fun). 20% is to pay down debt and savings.

A common medium-term plan is to reduce the amount of high-interest debt you have outstanding. This could be credit cards or payday loans. A typical long-term plan is saving for retirement.

3. Match Your Employer

The first question a financial advisor will ask is if you have an employer-sponsored 401(k) or any other type of retirement plan. The second question they will ask is if the employer matches what you contribute. Whether all of it or some of it it can make a big difference to how much you save.

Contributions now will reduce how much money you get at the end of the month but it’s worth maximizing your contribution to what your employer will match as that is free money.

4. Make Sure An Emergency Doesn’t Snowball Into A Disaster

A key to any financial plan is to create security for you and your family. One way to create a financial buffer is to make sure you have some cash available for emergencies – something that you don’t see coming. At first, you can start small – $500 would be enough to repair something that happens to your car or small emergencies around the house. It’s something that gives you a cushion to start. The goal of this buffer is to stop you from running up credit card or payday loan debts in an emergency. You might still need to borrow money but the first $500 would be covered by you.

After you have $500 in the bank then the next goal could be $1,000. Then you aim to cover a month’s living expenses. And so on and so forth. Motley Fool reports that only 47% of Americans could cover an unexpected bill of $500. Creating that buffer can put you in the minority that can cover it.

Another good way to protect your budget is to make sure you build up good credit. Building good credit means that if you do need to borrow money then you’ll be able to get the best terms and conditions when you do take out a loan. You’ll also get cheaper rates on insurance and other essentials around the house.

5. Get On Top Of High-Interest Debt

An essential part of any financial plan is to pay down and get rid of high-interest toxic debt. Toxic debt could be credit card balances, title loans, or payday loans. It could also be a rent-to-own payment that has a higher interest rate than regular debt. It’s any product that has an interest rate that means you could pay back 2 to 3 times the amount you originally borrowed. Hence why it’s called toxic.

If high-interest debt has got on top of you then you might want to look at a debt consolidation loan. You could speak to a specialist debt relief counselor who can help you find a product that would be right for you. You could combine a number of toxic debts into one manageable monthly payment.

6. Invest To Build Your Savings

The issue that most people have with investing is they don’t get started until they feel that they are ready. There is a perception that you need to be financially established before you start investing when really the opposite is true – investing is a good way to help you get established and build your finances. Investing could be something like increasing your 401(k) offering or it could be buying stocks and shares or in an index fund.

There are a number of ways you can use investing to help in your financial plan:

- Anything that is employer-sponsored: If you have a 403(b), 401(k) or any other similar plan then you should look to expand your contributions so that you max out the IRS limit of $19,500 every year. If you are over 50 years old then the limit increases to $26,000.

- Roth IRA: If you put money in an investment that has special tax advantages then you could build up your retirement savings by up to $6,000 every year. If you’re over 50 then you could save up to $7,000.

- College Savings Plans: These are sponsored by the states and give a tax-free investment vehicle to grow investments and then are usable for qualified education expenses.

7. Protect Yourself With Every Step

Working your way through these steps will help build a protective blanket for you and your family to protect against life’s unexpected surprises. As you continue making more money in your career then you can continue to increase your contributions. Continue to add more money to your retirement accounts, pad out your emergency expenses buffer and then use insurance to protect yourself in case of death or an accident.