It’s been an interesting couple of years. The pandemic and now we’re facing a potential recession. One thing we have all learned is the value of saving money. You don’t have to save huge chunks every month but get in the habit of saving and reducing expenses. It will help in the long run and put you in a good financial position.

Below we have listed some easy top tips to save money so you have access to fast cash if you need it.

1. Make Sure You Have A Financial Cushion

There is nothing worse than having a financial emergency (leaky roof, car repair) and realizing you don’t have the cash to pay for it. It happens to everyone but can be avoidable. Create a plan to have $500 set aside for a rainy day and work towards it. Once you hit $500, then aim for $1,000, $2,000, and so on. Your overall aim is to have 6 months of living expenses available just in case you lose your job.

2. Don’t Fall For Buy One Get One Free

It’s happened to everyone. You walk into the grocery store to buy milk and leave having spent $45. You think you got a good deal, but is it really a good deal if you spend $43 more then you wanted to? The buy one get one free “deal” is very addictive because of this. You might want to buy just one can of pepsi but end up buying 3. That extra money (even if you get more products) really adds up in the long run. And your rational brain knew you only needed one can before you went in. Try to make a shopping list before going in to the store to stay focused. Or be hyper-aware of what you are buying. Try to only buy what you need.

3. Switch Suppliers Often

Suppliers know that it seems like a big deal to switch. They count on this so that they can continue to raise their prices year on year. If you spend 15 minutes on a comparison website you could find better deals. If you are locked into a 12-month contract then put a reminder in your calendar to look when the term is up.

If you really don’t want to switch you can use the information you find to your advantage. You can take this to your current supplier and say that you will leave unless they can match the deal. This could save money and the hassle of switching to a new provider.

Do the same for groceries, gas and anything else you buy often. You could go through credit card and bank statements to see where you spend the most money and start there.

Constantly look at your bills to see where you can save money Especially anything that is contract based.

4. Don’t Let Your Ego Get The Best Of You

Own brands are as good as brand names. And they’re cheaper. Most large supermarkets have their own branded products. Typically they aren’t advertised as well, or as prominently, but they are there if you look for them. Switching to unbranded items can save you hundreds of dollars per year.

5. Remortgage When You Can

When your fixed-term mortgage has come to an end you might be paying more interest. Don’t accept this as something you have to do and shop around for a better deal. You can save money especially if you’ve paid down some of the principal. This will change your loan to value percentage and could give you a better deal. Speak to your mortgage broker about changing providers or use an online comparison website.

6. Eat All Of The Food You Buy

Research shows that more than 75% of what we throw away in the home is edible. This is a huge amount. And can easily be reduced. Make a conscious effort to eat everything that you buy and you will save money. If you can be aware of what you eat and what you throw away each month it could change your buying habits. This will save you money in the long run.

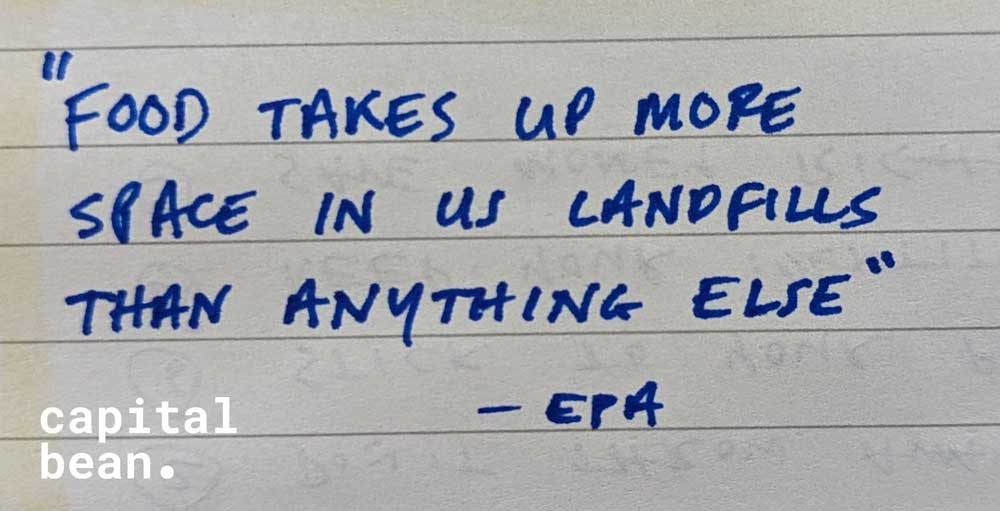

In the US food takes more space in landfills than anything else. This is according to the Environmental Protection Agency.

The key thing about reducing your expenditure is to then use the money you have saved and put it in a different account. It is no use saving all of this money and then spending it on something else.