Having a bank account makes money management simple. You might have been with your bank for a while and don’t like the customer service, or you want to take the new bank up on an introductory offer. There are many situations where you might want to move bank – it could be as simple as moving to another city and needing a new bank. You might want to find somewhere with lower fees or maybe you’re saving for a new house and you want somewhere with higher interest rates for your savings. Whatever your reason, we’ll talk you through the steps of switching banks.

It’s not necessarily a complicated process and if you follow the steps below you should be on your way. Our six simple steps will help you find a new bank or credit union.

1 – Find a New Bank

Now you’ve decided to change banks you’ll need to decide what your new bank will be. You typically have three choices – a credit union, an online bank, and a traditional bank. Even within these three categories, there are lots of options to consider.

It’s useful to have a checklist when comparing banks or credit unions. As you start to shop around and compare different products you should consider the following:

- What features and benefits are most important to you. Do want to be able to access a physical location or are you OK with online access

- What fees are charged on a month-by-month basis

- Interest rates your savings will earn

- Mobile and online banking options

- ATM locations

You might move bank so that you have access to more ATMs.

Consider whether switching banks might earn you some money. Many banks give introductory offers when switching to encourage you to join their bank. You can also get bonuses and rewards.

Also, make sure to look at the minimum opening balance and deposit requirements. If you only have $500 in your account right now and the minimum opening balance of a bank is $1,000 you’ll need to save up more money to move to that bank or take that one off your list.

Remember that you don’t need to have all of your money with one bank – you could have savings at one bank and your current account at another bank.

2 – List Out Every Automatic Payment and Deposit You Have

To make your life easier you probably set up direct deposits, automated bill payments and recurring transfers. This is great until you decide to move bank and need to remember every payment that has been set up. You’ll need to manually switch all of these to your new account so start by making a list.

A good example of this is if you get your paycheck automatically sent to your old account then you’ll need to make sure this is redirected to your new bank. Or you might be paying off a payday loan which typically have incredibly high fees if you miss a payment.

If you want to move bank then make a note of:

- Recurring Subscriptions: Gym memberships, cell phone bills, streaming services or broadband. Anything that is paid automatically.

- Automatic Deposits: Anything that is directly deposited in your bank. This could be income from your business, paychecks, child support, alimony, or any government payments and recurring transfers.

- Automatic bill payments: Your mortgage or rent will be the big ones followed by utilities, student loans, or credit cards. These are important because the penalties can be high if you miss payments.

- Recurring Transfers: Savings, retirement accounts or investments or IRAs.

On top of this list, you should also make a note of anywhere your bank account is currently linked online. You might have your cards saved on apple pay and so you’ll need to update this with your new cards. If you go outside without your wallet and rely on your phone this might get you in trouble if you don’t have a card to pay with.

3. Open Your New Bank Account

Now that you’ve selected your bank account and made a list of all your automatic transactions you can open your new bank account. A number of banks now allow you to open your account fully online – this makes it very easy to switch banks.

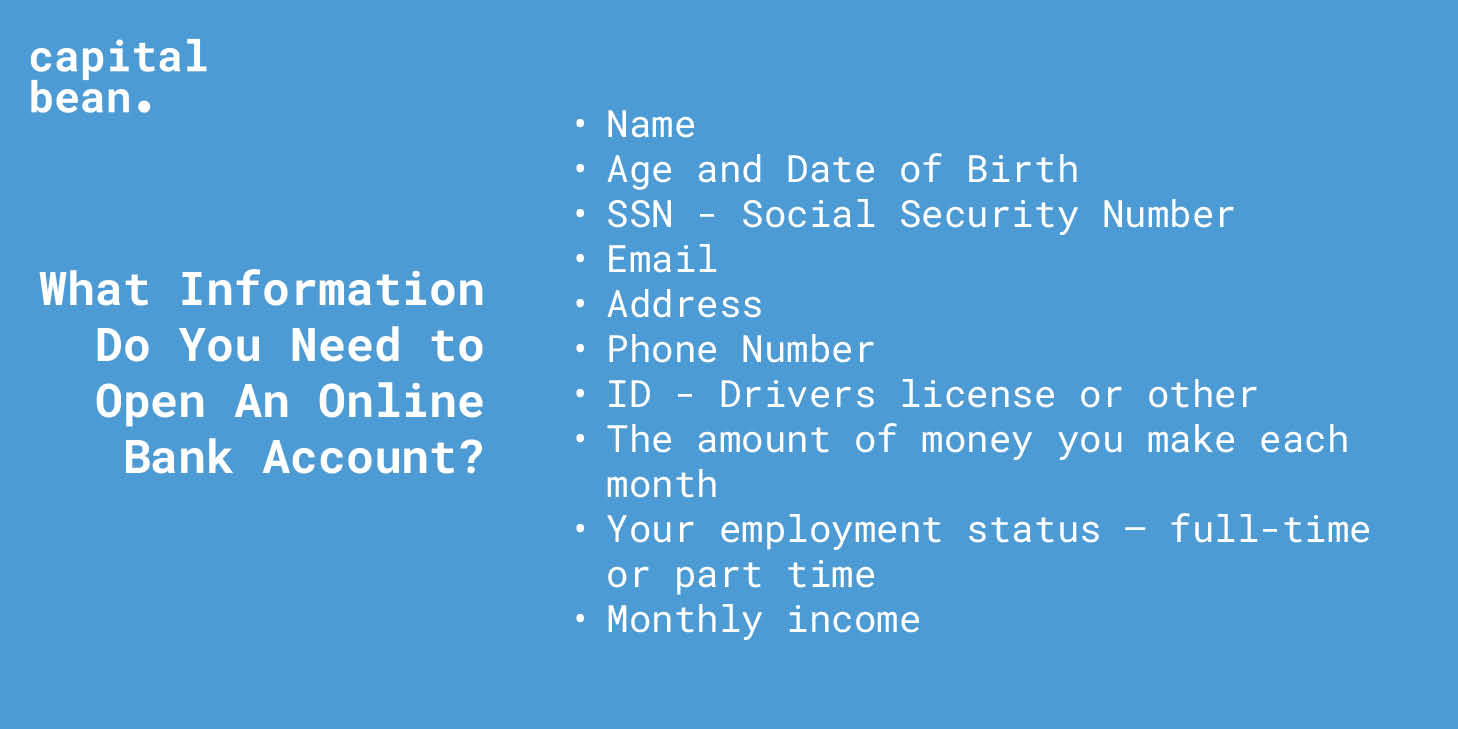

To open a new bank account you’ll typically need to provide:

To open a bank account you’ll need the following information: age and date of birth, SSN – social security number, email, address, phone number, ID – driver’s license or other, monthly salary, your employment status – full-time or part-time and your monthly income.

If you are going to switch your bank online you’ll need to tell them how you plan to fund your account e.g. where is the money coming from for the first deposit. You’ll need to give them the routing number and account number for your old bank account so that the money can be transferred across.

Many online banks will ask for extra verification around your deposit information for a linked account before you move your money across. This process will typically involve making one or two small test deposits into the account to verify the information. Once these payments are verified you can link your two accounts together to make the transfer.

If you want to open your account in person at a bank branch then you could take out cash from your current account and then go and deposit it in your new bank account. If you want to deposit more money than you’re comfortable carrying around then you could use a cashier’s check or a certified check in the place of cash.

4. Sign Up For Mobile and Online Banking

Good news – you have a new bank account that is set up and has some money deposited in it. Now you need to be able to access it. It’s no good having money in the account if you access it when you’re out and about. Online and mobile banking will be the only way you can get your money if you’ve signed up for an online-only institution. You generally get better deals with online institutions but lose access to real people in a real branch. The pros and cons of online-only banking!

If you’ve decided to bank with a brick-and-mortar institution then your credit union or bank will be able to help you with online banking. The first step to using this feature is to enroll and then when that is done you can log in through the bank’s online portal.

After that, you might want to download the bank’s mobile app. If set it up properly you should be able to use the same user ID and password that you set up on their website. Many banks have multi-factor authorization to make sure that your bank account isn’t accessed by other people. Typically they will send you a text or use an authenticator app to help prove that it is you.

5. Update Your Other Automatic Deposits and Payments

Now your account is open, you’ve deposited money in it and you can access it online it is time to update the automatic payments that you had linked to your old bank account. You won’t want to miss any payments as you might get late penalties and fees if you do.

Before you start this process you could review the list of payments that you make to see if you want to cancel any. This is a great time to be reviewing and cancel any items or categories from your budget that you no longer need or that have gone up in price.

Once you figure out what you want to keep and cancel then you can update all of your account information:

- Begin with Direct Deposits: Start with the most important payments – anything that would get you in trouble if you don’t pay. Were thinking of alimony and child support payments or anything to do with government benefits. You will need to update each one individually – you can’t just tell one institution and think that it will be updated everywhere.

- Next, Reschedule Any Automatic Bills: If you have bills that are set to be paid automatically you can do these next. Like with direct deposits you need to update each one individually.

- Finish With Recurring Transfers: Finally, make sure to set up any recurring transfers that you made. A common one is any money that is transferred from your checking to your savings account. You don’t want your budget to be out of whack.

If you use paper checks then you’ll need to order a new checkbook – you don’t want to go overdrawn on a bank account that you don’t use anymore. This is a good example of why you want to leave a bit of money in your old account to start – so that if you’ve missed any recurring payments there is money to cover them. If you’ve missed any recurring payments then leaving it open one full billing cycle can help you spot them.

6. Close Down Your Old Account

You can close down your account after you’ve left the bank account open for a full transfer cycle and you’re confident that you’ve updated everything. This will be the final step – closing down your account. Depending on who you bank with you might need to go into a branch, or alternatively, you could do it online or by phone.

As part of the process to close your account make sure you get written verification from the bank that it has actually been closed. This is important because if a payment goes through or a deposit is made that triggers fees you can prove that it had already been closed. You’ll also want to find out if there are any closing fees before you start the process. Some banks charge fees if you close a bank account within a certain period after opening it.

As a final step, you’ll want to destroy any paper checks that you have from the old bank and also destroy your debit card. When you receive your final statement make sure to check it closely. You want to check it for any deposits or payments that you have missed and need to transfer.

Should I Switch to a New Bank?

You might be reading this article and wonder why you would want to switch banks if you don’t need to. You might be asking questions like:

- Will I be penalized if I switch banks?

- Will my credit score be impacted if I switch banks?

- Is it difficult to switch banks?

- Can I switch banks online?

When you switch a bank essentially your money moves from one institution to another institution. You open a brand new bank account and close your existing bank account. There are many things that you’ll need to update including direct deposits and anything else that comes out of your account on a recurring basis.

It might be a good idea to switch banks if:

- You can get a better % return on your deposits

- You get lower fees at your new bank

- There is a bonus for setting up a new account

- The customer service at your existing bank is not up to standard

- You need more features from your bank

- If you borrow money it would be cheaper because of the fees and interest rates charged.

- The new bank has a more comprehensive ATM network or has a branch in your town or city

- You want to move your banking online

Switching banks can take time and energy and so before you do you should speak to your existing bank to see if they can match the offer you’re going to get from the new bank. It won’t hurt to ask. If they say no then you can go ahead and switch banks as you’d planned already.

You might also be wondering if it is difficult to switch banks? No, it’s not hard, it just takes some time. You’ll need to use the checklist above or even speak to your bank as they sometimes provide a list to move accounts. You can also find bank switch kits online to make the process streamlined.