Are you dreaming of a backyard oasis but worried your credit score will sink your chances? You’re not alone. Many homeowners face the challenge of securing a pool loan with less-than-perfect credit. But don’t let your credit history keep you from making a splash. There are ways to navigate the financial waters and secure the funding you need.

Understanding your options and what lenders look for can open the door to pool financing, even with a dived credit score. From seeking out specialized lenders to exploring alternative financing routes, you’ll discover that a few strategic moves could put that pool within your reach. Ready to dive into the details? Let’s get started on your journey to a dream pool, no matter your credit score.

Specialized Lenders for Bad Credit

Navigating the financial markets to find a loan for your dream pool is daunting, especially with a less-than-stellar credit history. But fret not, as specialized lenders focus on clients like you. These lenders understand that life events can cause financial hiccups and are willing to consider more than just your credit score.

For starters, you’ll want to look for lenders who offer bad credit pool loans. They often evaluate your financial stability, employment history, and income in addition to your credit report. Here’s what you can usually expect:

- Higher interest rates: Lenders take on more risk by loaning to individuals with bad credit, which results in higher interest rates compared to standard loans.

- Flexible terms: Some lenders offer more flexible loan terms to make repayment more manageable.

- Additional fees: Be aware that origination fees or prepayment penalties may apply.

Securing the Right Lender

Focus on lenders who specialize in bad credit loans. A little research can reveal lending institutions are well-versed in handling various financial situations. Remember to:

- Compare rates from multiple lenders for the best deal.

- Review terms and conditions closely.

- Understand any additional costs involved.

It’s crucial to prepare documents that show your financial responsibility. Demonstrate steady income or provide evidence of recent economic improvement. The more transparent you are, the better your chances at a favorable loan package. Before applying, ensure you’re fully informed about each lender’s process and criteria. This prep work won’t just impress lenders—it’ll also boost your confidence while securing a loan.

Improve Your Credit Score

Improving your credit score might seem daunting, especially when you’re eager to plunge and install your new pool. However, you can enhance your financial standing with a few strategic moves.

Review your credit report thoroughly for any errors. You’re entitled to a free credit report annually from the three major credit bureaus. Identifying and disputing mistakes can lead to a quick improvement in your score.

Reduce your credit utilization ratio by paying down credit card balances. Aim to keep the ratio under 30%, as lenders look favorably upon this as a sign of responsible credit management.

Pay your bills on time, every time. Payment history accounts for a significant portion of your credit score. Setting up automatic payments can help you never miss a due date.

Consider taking out a credit-builder loan or securing a secured credit card. These financial tools help individuals with poor or no credit prove their reliability without the high risk of a traditional unsecured loan.

Don’t close old credit accounts, even if they’re paid off. The length of your credit history impacts your score, and longer credit histories are beneficial.

Lastly, avoid taking on new significant debts while you’re working on improving your credit score. Hard inquiries from credit applications can temporarily reduce your score. Stick with your goal; your fiscal responsibility can lead to opportunities beyond securing a pool loan.

Explore Alternative Financing Options

Traditional pool loans may not be within reach when your credit score is low. However, don’t let that deter your dream of a backyard oasis. Alternative financing options can be the key to making your pool project a reality.

Home Equity Lines of Credit (HELOCs) can be a viable option if you’ve built up equity in your home. These lines of credit typically offer lower interest rates than unsecured loans, making them an attractive choice for financing a pool. Remember, your home secures the loan, so making payments on time is essential to avoid risking foreclosure.

Another route to consider is acquiring a personal loan from a credit union. Credit unions are member-owned and often more lenient regarding lending criteria. They may offer you a personal loan with more favorable terms than a bank, even if you have less-than-perfect credit.

For those looking for a no-collateral option, peer-to-peer (P2P) lending platforms may be the answer. P2P lenders connect borrowers with investors willing to fund loans without traditional bank intermediaries. These platforms often have flexible credit requirements, benefiting those with lower credit scores.

Assess your qualifications for these options about interest rates, repayment terms, and potential impact on your credit. Always read the fine print and understand the full scope of any loan agreement before proceeding.

Gather Documentation and Financial Information

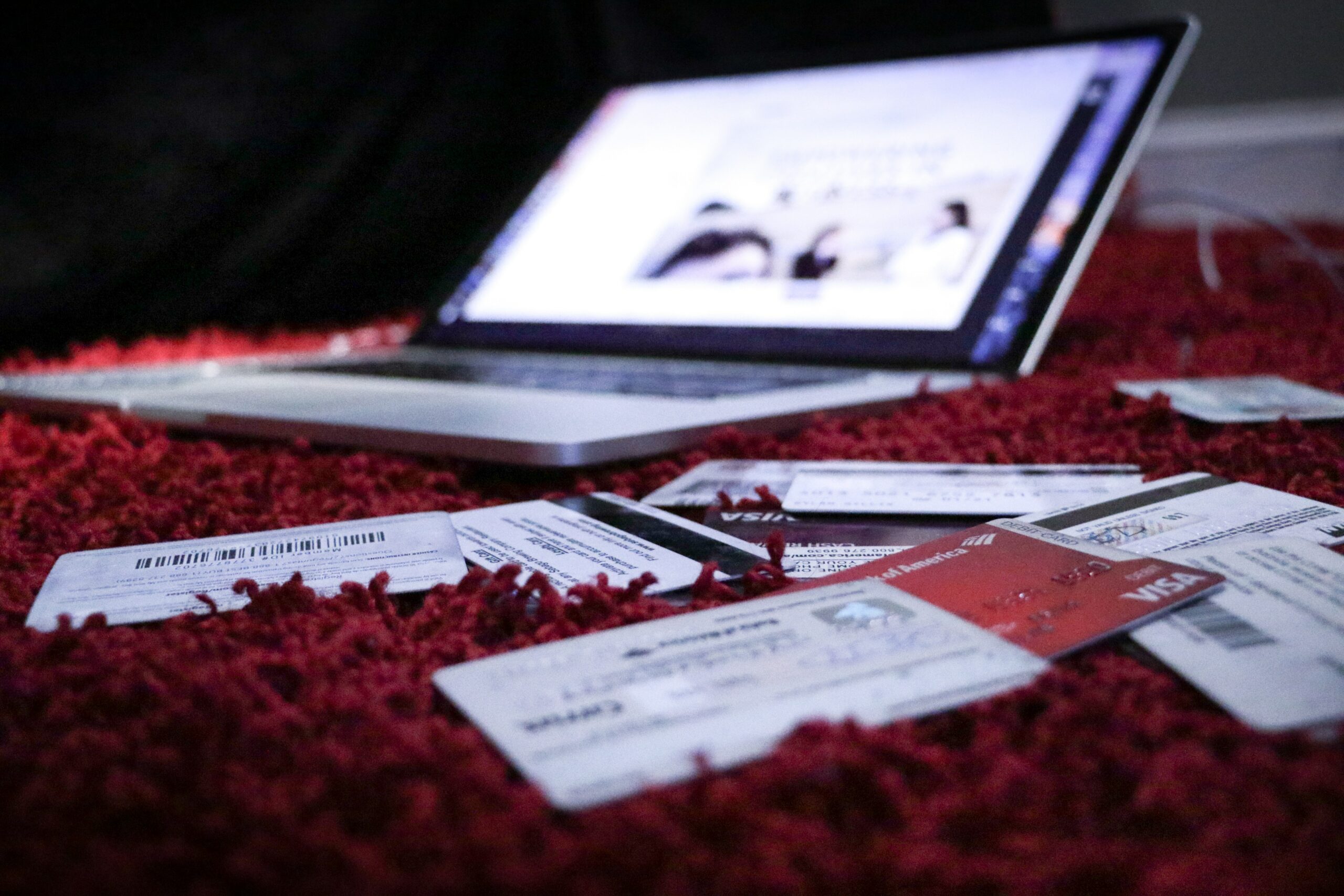

Before approaching lenders, it’s essential to be prepared with the necessary documentation. Lenders will scrutinize your financial responsibility, especially if your credit score isn’t tip-top. Here’s what you’ll need to have on hand:

- Proof of income: This may include recent pay stubs or tax returns. It establishes your ability to repay the loan.

- Bank statements: These demonstrate your cash flow and financial stability.

- Financial history: Includes any records of past loans and debts to give a complete picture of your economic behavior.

- Proof of identity: A government-issued ID is typically required to prevent fraud.

- Collateral documentation: If you’re considering a secured loan, you will need documents related to the asset you’re offering as collateral.

You’re more likely to gain the lender’s trust by providing detailed and accurate financial information. Ensure that all documents are up-to-date and present a realistic view of your financial situation.

Understanding your affordability is also crucial. Calculate your debt-to-income ratio by dividing your total monthly debts by your gross monthly income. Lenders typically look for a ratio that’s less than 43%. This calculation helps you understand how much you can realistically afford to borrow without overextending yourself financially.

Ensure you continually monitor your credit score and report. That way, you’ll be ahead of the game should there be any changes or improvements that could positively impact your loan application process.

Prepare a Detailed Pool Project Plan

Lenders want confidence in your project’s viability when you’re looking to secure a pool loan, especially with bad credit. You’ll need a comprehensive plan that outlines your vision from start to finish. Begin by listing the pool’s size, type, and materials. Specify whether it’s in-ground or above-ground, and consider any landscaping or decking complementing it.

Detail every aspect, including:

- Design and aesthetics

- Construction phases

- Timeline

- Projected costs

- Maintenance budget

Research contractors with a solid reputation and obtain quotes to include in your plan. Transparency about costs not only helps in getting a loan but also aids in staying within your budget once the project commences.

Remember, clarity is paramount when presenting your plan. A well-prepared project plan demonstrates your severe intent and capability to handle a loan, potentially swaying lenders to look past your credit score. Include visual aids or blueprints if possible; a picture can be worth a thousand words in showing the lender exactly what you envision for your pool project.

By highlighting how the pool will enhance your property value, you bolster your case for the loan. Property improvement is a convincing argument as it assures the lender of recovery potential in case of default. Remember that your project’s plan is a critical tool to negotiate loan terms, possibly securing better interest rates or down payment options.

Conclusion

Securing a pool loan with bad credit isn’t out of reach if you’re prepared and strategic. Before approaching lenders, remember to gather all your financial documentation and understand what you can afford. Your pool project plan is your blueprint to success—make it comprehensive and visually appealing.

You’ll improve your chances of favorable terms by demonstrating the added value to your property and showing an apparent ability to manage the loan. Stay confident and ready to negotiate; your dream pool might be just a well-prepared loan application away.

Frequently Asked Questions

What documents do I need to secure a pool loan with bad credit?

You will need proof of income, bank statements, financial history documentation, proof of identity, and collateral documentation.

How can I prove that I can afford a pool loan?

Showcase your stable income, manage your debts effectively, and prepare a thorough pool project plan outlining all projected costs and maintenance budget.

Why is a pool project plan essential for securing a loan?

A detailed pool project plan demonstrates your organized approach and serious intent. Including a vision, design, construction phases, timeline, projected costs, and maintenance budget helps lenders understand and assess your project’s feasibility.

Is monitoring my credit score necessary for a pool loan?

Monitoring your credit score and report is crucial because it can influence loan terms. Awareness of your credit status allows you to address any issues or inaccuracies.

How can a pool increase my property value?

A well-constructed pool can enhance your property’s aesthetic appeal and functionality, making it more attractive to future buyers and increasing its overall market value.