You might have driven past a credit union when you’re in your hometown but never knew exactly what it is. At the core, credit union’s are owned by their members and are not-for-profit organizations. They always seek to put their member’s own interests over profit and can offer very low cost loans for their members.

What Is A Credit Union?

Credit Unions are similar to banks in that they’re financial institutions; the critical difference is that the members own the credit union. Compared to a bank, they look to put their member’s interests above all else over making just a profit. Because of how they’re set up, credit unions offer lower rates for loans, better rates for savings, and overall lower fees.

It’s a great way to organize as a financial institution, but not everyone can join. Depending on how the credit union is organized depends on what the entry requirements are. Read on to find out what you need to know if you are considering joining a credit union.

What is The Difference Between a Credit Union and a Bank?

Credit unions and banks work in a very similar way but have different primary goals as an organization. At a bank, when you deposit money, you are a customer. A bank has a primary concern for its shareholders and not its customers.

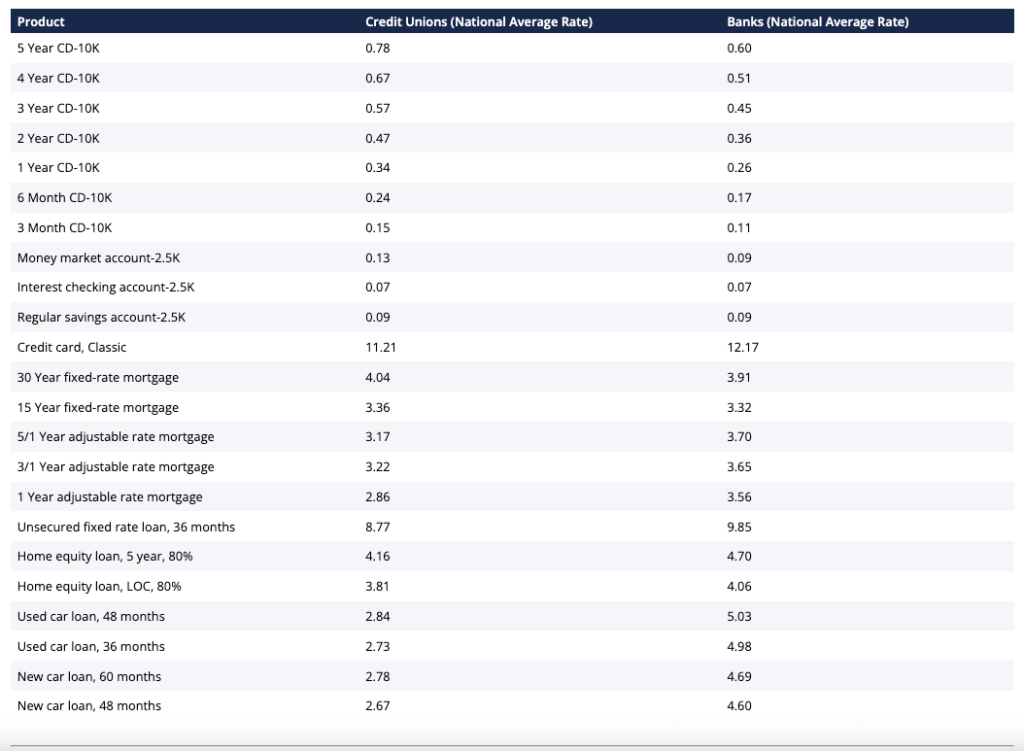

Typically, banks offer higher interest rates on loans and lower interest rates on savings compared to a credit union. Banks are looking to maximize their profit and increase the difference between the interest rates charged on their loans and the interest rate they give to their customers for their savings. This is one of the most significant differences between credit unions and banks.

How Do Banks And Credit Unions Compare?

| Credit Unions | Banks |

| Non-profit | For-profit |

| Money goes back to members | Money goes to shareholders |

| Local branches | National branches |

| Membership required | No membership required |

| Lower, competitive rates on products | Standard market rates on products |

| Few products available | Many products available |

| Local, personal customer service | Standard national customer service |

The USP of a credit union is that they’re member-owned. Instead of in a bank where when you deposit money, you’re a customer, when you deposit money in a credit union you become a part-owner in the credit union. You are both an owner and a customer simultaneously. A credit union will then use the money that you and other members have deposited to make loans to other credit unions around the United States, in the same way that a bank does.

Because a Credit Union is set up to maximize the benefit to their members, instead of taking the money that would be profit, they are instead used to support other credit union members. This is accomplished by giving better savings rates on their products and also decreasing the interest rates on loans. Sometimes credit unions even offer lower fees too.

How Many Credit Unions Are There In The USA In 2023?

The most up to date information we have is from December 2021. At this time there were 4,942 federally insured credit unions in the United States with 129.6 million members

Key Points

- Credit unions are a type of financial institution

- They are member-owned meaning that members are both owners and customers

- Due to being member-owned, loan terms are set up to favor the borrowers

Advantages of credit unions

All too often people work with a bank without realizing that they have other options. They never even consider that working with a credit union might be beneficial to them compared to working with a bank.

The main advantages of working with the credit union are the following:

Lower fees compared to a bank

Banks make a lot of their money through fees that include service charges that they charge monthly and also the fees that they charge when starting the lending process. Typically the fees associated with a Credit Union are lower than the fees that a bank charges. On top of this fees for transferring money or lower and also ATM fees tend to be non-existent. Finally, fees for going into overdraft are much lower too. Banks tend to make a lot of money from charging fees on overdrafts which means that the lower overall fees charged by Credit Unions make it more affordable than a bank.

Customers come first

One of the great benefits of depositing money with a credit union is that you become a member-owner of the union. There are no stockholders, so priorities are misaligned between the members and shareholders. This is a key difference between credit unions and banks. Banks are for profit. Credit unions are not for profit.

This shift to a non-profit business model changes the entire focus for the Credit Union leadership team away from profit generation and towards giving customers/members the best possible customer service and experience. As a bonus, Credit Unions are typically more forgiving than banks when it comes to overdrafts and being overdrawn in your checking account. They’re also more open to working with those who have a lower credit score. They’re also more willing to work with you if you find yourself temporarily out of work or without a steady paycheck.

Lower interest rates on loans

Because credit unions aren’t focused on the profit they can afford to charge lower rates for their loan products across the board, making them a lot cheaper than payday loans or other similar short term loans. They need to make sure they’re covering operating expenses And because they’re not paying out hefty bonuses they can offer lower interest rates on loans. If personal loans are around the 36% APR mark and payday loans are around 300% to 500% APR, the rates below for credit unions are far less, with unsecured loans at 8.77% APR (March 2022).

Higher interest rates on savings

At a credit union, the interest you receive on your savings is higher. It’s typically higher than a local bank but it might not be as high as some rates offered by online banks.

Bad credit is considered

Credit unions are normally more willing to work with you than a bank is especially if you have a poor credit rating. They’re even able to offer loans to those with poor credit history. Typically a loan officer will meet with you face to face and look to find a loan that suits your requirements closely.

If you’ve always dreamed of buying a house with a mortgage but have a poor credit rating a credit union might be a great place to start. They also offer educational resources to help you understand your spending habits and budget to develop better long-term behaviors that could help increase your credit score.

It’s worth knowing that if you have a poor credit score and you want to get a loan from a credit union it’s worth applying in person. This is because you’ll be able to explain your circumstances in more detail versus filling out an online form which takes away the personal touch.

A credit union is more customer-focused than other types of lending and may also offer lower fees than traditional institutions.

Qualifications to join

They don’t let everyone in. There are rules in place that govern who can join a credit union. There could be a range of requirements but some of the main ones are around where you live, who you work for, or whether you’re in full-time education or not.

If you do join a Credit Union membership is for life. You can maintain your membership even if you no longer meet the requirements that you originally had to meet to join. You can maintain your membership but they might have other requirements that you need to meet like having a shares or savings account with them that is kept in good order.

It’s worth researching credit unions in the area before you decide to apply. At some large companies it’s a perk to have a membership to a credit union and so if you work for a large company it might be worth starting there. Otherwise you can start with your geographic area and look around there before widening the search.

The union guarantee

Credit Unions belong to the National Credit Union Administration whereas banks belong to the FDIC. The NCUA is a comparable accreditation that is equal to the FDIC. Your account is guaranteed up to $250,000 if your credit union fails for whatever reason.

When looking for a credit union either through your organization or in your local area always make sure that the credit union you are joining is backed by the NCUA so your money is safe.

Disadvantages of a credit union

There are many advantages to joining a credit union but some drawbacks. Firstly there are the membership requirements that not everyone can meet to join them. They also tend to be smaller than banks which could be difficult if you’re traveling and need to withdraw money from an ATM. Even though credit unions don’t charge ATM usage fees in their own network, if you’re away on a regular basis you may need access to a regular bank that has a wider network of ATM locations.

You also might have access to fewer products at a credit union compared to a bank. Banks typically offer a huge range of savings, checkings, credit accounts as well as loans and investment advice and management. At a bank you typically have options to find a product that works for you that rewards you in the way that suits your lifestyle. A credit union might only offer one or two options for each product which could limit your choices and options.

One last issue is that credit unions are not always technology-focused and don’t invest the same amount as a bank in technology-focused products. The experience you have working with your credit union online might pale in comparison to a large bank that typically offers apps and online portals.

Do your due diligence

Joining a bank or an association is a big commitment. Make sure to do your homework. Research the pros and cons of both a bank and a Credit Union. Look into the backgrounds of the banks and make sure to read all of the fine print associated with whichever product you’re deciding to buy.

If you’re looking for that personal touch, better interest rates and most importantly low fees than a credit union could be right for you. If you’re looking for technological advancement, convenience and a wide range of specialized banking products then you might be better off with a bank. Or you can get the best of both worlds and open an account with a bank and a credit union to get the benefits of each.