The Uptake Of Federal Student Loans Has Increased In Recent Years

Federal student loans were set up by the government as a type of financial assistance to help pay for the costs surrounding college and other higher education. 1958 was the first time that a government-backed student loan was offered under the National Defense Education Act.

In recent years, there has been a boom in the uptake of this type of student loan. The DoE Office of Student Aid provided over $120 billion dollars each year to college students through different types of federal student loans.

There are two different types of loans. Unsubsidized and subsidized. A subsidized loan is means-tested. Means-tested is when the government looks at the students, family, income, and background to anticipate whether they can afford to repay the loan. Subsidized loans are cheaper for borrowers because the student will not pay the full amount – hence the subsidization.

Unsubsidized loans do not need any financial history and you can apply for them easily because you are taking on the full debt to repay over your lifetime. It’s still a type of debt and needs to be repaid back.

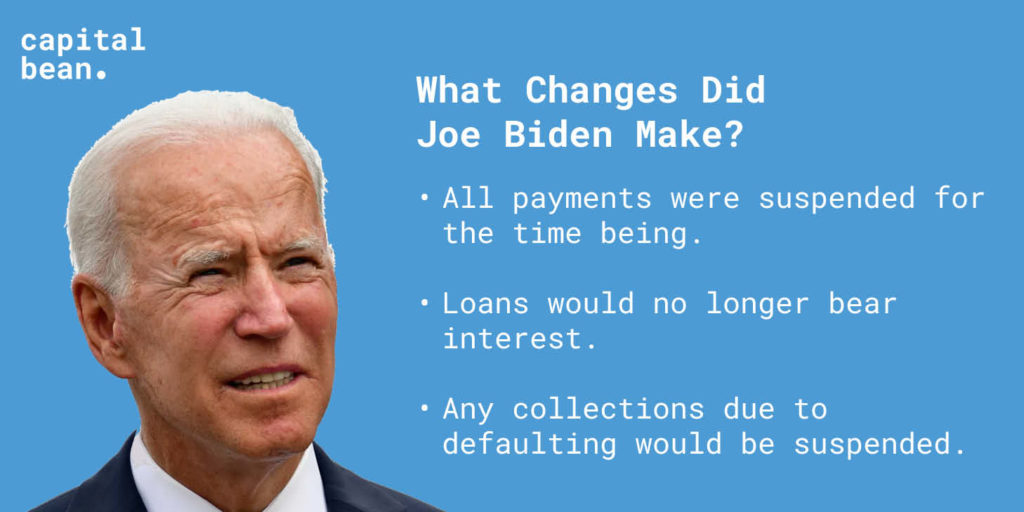

What Changes Has President Biden Made?

For most student loans, you have to pay interest which makes repayments significantly more expensive for borrowers. When we looked at the data in 2019, the interest rate was 6.08% for unsubsidized graduate loans and a significant 4.53% for subsidized loans. When Biden took over the presidency and was looking at this during the coronavirus he made a couple of key changes to the program as of March 2020.

These regulations were initially introduced as a temporary measure through the CARES act, but Biden has continued to increase the scope of this program, which is impacted more than 40 million students across the US.

These regulations were initially introduced as a temporary measure through the CARES act, but Biden has continued to increase the scope of this program, which is impacted more than 40 million students across the US.

Originally these measures were going to end at the end of January 2022 but he then pushed this back to May 2022.

When Payments Resume What If I Can’t Pay Back My Student Loan?

These measures have provided a huge amount of short-term relief but won’t last forever. It is important to try to get ahead of the loan repayments as we are still not sure when these measures will end.

As long as you stay in full-time employment, you will be required to repay your loan each month. If you are in full-time employment then you should budget to see how much you are earning and how much of your income is going to go towards this student debt. Remember – if you have other debts as well, you’ll have to factor these in.

You should plan your spending carefully, especially if you have other secured or unsecured debt.

If you are classified as under-employed, then you might be able to defer payments for up to 3 years. However, if you’re fully employed and are struggling to make ends meet, you might need to apply for a loan to help pay off all of your debts.

Biden Is Working With Borrowers To Try To Get Them To Forgive Debts

The administration under Biden is working incredibly hard to try to help the borrowers. Forgiveness is a term used in financial circles that means to cancel or defer debt. This would mean that all or some of your outstanding payments would be waived and you would no longer need to make any monthly payments.

Currently, forgiveness usually happens if you’ve been disabled or work in underserved areas. If you’re employed by the government or working nonprofit, you might be eligible. Similarly- if you are working as a teacher in some areas, you may get a loan reduction of up to $17,500.

To help people retroactively Biden is allowing people to submit a waiver to write off the cost of past repayments that didn’t count. This will continue until almost the end of October 2022.