When you use the debt snowball method you keep focused by rewarding yourself with small wins along the debt payment journey. You start by paying off your smallest debts first and then taking the money you’ve saved by repaying those debts you use it to pay off your next biggest debts. It gets the name because it is like rolling a snowball down a hill, picking up momentum and size as it is going down the hill.

Because you get small victories as you start it gives you satisfaction and should help you keep on track as you move towards bigger debts. It is different from the avalanche method of debt repayment because it prioritizes high-interest debt first. The downside to the avalanche method is that it might take longer to pay off the first debt.

How Do I Use The Debt Snowball Method?

To start you need to make sure that you have budgeted enough to pay off the minimum payment for each debt each month. Then take the debts and arrange them by the amount of the balance and organize them in that order. Ignore the interest rate on each payment.

Once you’ve worked out your budget you can take the extra money you’ve budgeted to get rid of debt and use it to pay off your smallest debt. You repay your smallest debt even if the interest rate on another debt is higher than this one. Once you’ve paid off the smallest debt you can take the entire amount you were putting towards this debt and then target the net smallest debt. You will keep paying off debts in this way and then using all the rolled-up money to pay off the next debt.

The snowball method helps you pay off the smallest debts first to create momentum.

This method can make financial people a bit crazy because you’re actually spending more money not paying off the high-interest debt first. If you do want this method then the budgeting avalanche is best for this. However, if you want early small, and consistent victories then the snowball method can work best.

Look For Ways To Pay Off More Debt At A Lower Rate

If you do follow the snowball strategy and your debts with high-interest rates are the highest then you should look for ways to find lower rates. This is especially true if your credit score is increasing because of your inability to pay back debts. You might be able to move your balance to a credit card or even look to consolidate your debt.

Some people worry that they’ll never be able to pay off their debt even with a plan like the snowball. The main challenge is to stay focused and keep on plan, regardless of how it feels. If your debt from unsecured sources (credit cards or payday loans) would take more than 5 years to repay then you might want to look at debt relief options.

The snowball and avalanche methods of debt repayments both involve budgeting to pay down debt, you can also use the debt snowflake method which is where you take any extra money you’ve ‘found’ and use it to make debt repayments. This can help increase your progress as it is money that you didn’t have in your budget originally.

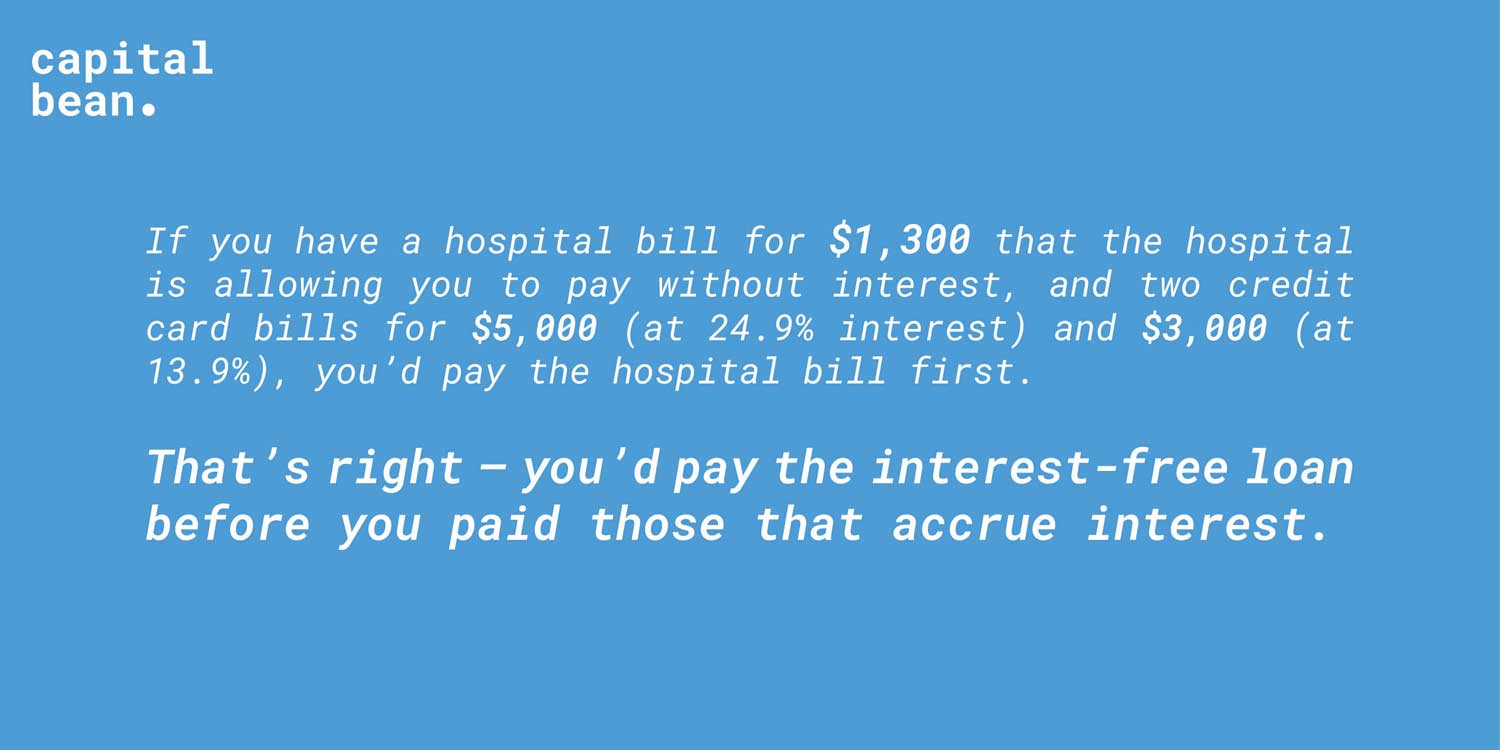

Here is how that could look in practice:

Is A Debt Snowball The Right Method For Me?

The avalanche method might mean that you save more money on interest but it isn’t the plan that counts, it’s your ability and willingness to stick to a plan that makes the difference. Even if you have an incredible plan that would get you out of debt, and you don’t stick to it, then it’s pointless. The debt snowball might cost you a bit more interest in the long run, but if you can stick to it then it might be the best plan.

Studies have shown that the fraction or percentage of debt that is paid consistently is a better predictor of success than the total dollar amount. As with everything, achieving sub-goals can help you achieve a larger goal in the long run. Positive reinforcement will help you in the long run.