When you start or run a business it takes money, time and energy and wherever you can save on one of those (or all of them) it will help you out in the long run.

Whether you decide to bootstrap your business or raise money from a bank or family and friends, it is always a good idea to keep an eye on your outgoings which will reduce the financial pressure on you and your business month to month.

If you are starting a service-based business (consulting is a good example of this) then your main cost will be your time and energy because it will be you (at first) going out and selling and delivering the services. If it is a product-based business then you will need to keep in mind the cost of your stock or inventory which you’ll then need to sell.

Regardless of what kind of business you are starting, there are a number of ways that you can save money. Below we’ve listed some of the top tips that you can follow to make sure you keep your expenses as low as possible.

Do You Need Office Space For Your Business?

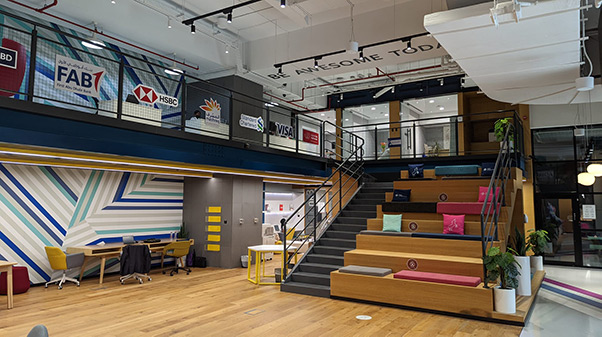

In the last few years, the opinions of businesses without an office have changed. And the pandemic has certainly shifted this mentality too. It used to be a sign of success that you had a fancy office with a good location and name on the door. Not any more. Most people now understand that you can work well from home and don’t need to be commuting to an office every day.

Especially when first starting out a business – ask yourself, is this really an expense that I need right at this moment. Even if you get a shared office space you will still be paying out $300+ per month that could go somewhere else. Especially if you multiply that by the year ($300 x 12 = $3,600) then you’re looking at big savings over this time period.

Some argue that they aren’t efficient, or don’t have the space at home to work effectively. This could definitely be true and it will be up to you to decide whether this expense would make sense.

Saving Costs When You Do Have an Office

If you do decide to take on an office then make sure to calculate the full cost. If you go with a co-working space then the amount you pay every month will be fixed and you won’t need to worry about bills, business expenses and other costs that might crop up. If you decide to take on a lease on a full office space then your rent might just be the first part of your expenses – you’ll have utilities, business rates, and costs of maintenance, cleaning etc. These can really add up.

Make sure that you calculate the full cost of an office before signing a lease as it can be difficult and expensive to get out of a lease once you have signed it.

Then you can keep an eye on your expenses. Keep energy usage to a minimum (turn off all switches and power when you leave in the evening), and try to be prudent with your usage of other utilities.

You Have More Negotiation Power Then You Think

When you’re first starting out you might think that you don’t have any bargaining power when getting utilities and other essentials for your business. Many people don’t negotiate because they are scared of being turned down, getting embarrassed or they don’t realize that they can ask.

If you don’t ask, you’ll never know. And this is important for an entrepreneur because you’re going to have to sell your business in one way or another and so getting used to talking about money, haggling, and negotiating will put you in good stead as you move your business forward.

Think about where you’re spending the most money – is it on telephone bills, internet, offices, or even cleaning? Start with something small and ask for a discount on your monthly expenses and see what happens. If you’ve been in your lease for a while and you’ve noticed that there are open offices, your landlord might be open to negotiating rent, especially if you’re thinking of going somewhere else (and they know that!)

Think About Your Staff or Freelancers

When you first start out you’ll be doing everything yourself – selling, delivering, and the million other things that you need to do as a founder. Eventually, you’ll probably get to the point where you need some help – there are only so many hours in the day to get things done.

At this point you’ll have a decision – do you hire someone part-time, permanently, or as a contractor. Each one has pros and cons that we’ve listed below:

Full Time

Pros

- Full time support for either a specialist role or to generally help. Employee number 1 at a start up is usually a bit of an all rounder.

- Should buy in to the company and feel personally invested in the success of the business.

- You can gets lots done in five days a week.

Cons

- Full time salary needs to be paid at the same time each month – no excuses.

- Can be tough on cash flow.

- You need to make sure that they have enough work to do day-by-day.

Part-time

Pros

- Can help out on specific tasks and actions that you need help with.

- Can be available on teh key days when you need support.

- Might be able to help for weird hours of the day as they aren’t working all the time.

- Less salary to pay each month.

Cons

- Might not be able to get all the work done that you need them to.

- Might not be fully focused on the role if they have a second job or other part-time work.

Contract workers

Pros

- Pay them just for the hours / task / job that they are completing

- Motivated to get the work done as quickly as possible – especially if they’re being paid for the job. They want to get it done and not spend extra time on it.

Cons

- Might not buy in to the company vision as they only work on specific jobs / projects.

The Pomodoro Technique

When you talk about saving money – we normally think about the money that you can spend – but at the top of the article, we also mentioned that you need to manage your own energy and time. The Pomodoro Technique breaks up your time into smaller 25-minute chunks that allow you to focus your time and energy on what is important – completing the task at hand.

You set a timer for 25 minutes and then tell yourself that you won’t do anything else until you finish what you wanted to. In this way, you can manage your time and energy accordingly.