Yes, it is possible to get payday loans for bad credit, with most lenders across the US always able to take a view on bad and poor credit scores. To be eligible, you ideally need to meet the initial criteria such as being over 18, a full-time US resident, employed (full-time or part-time) and able to meet repayments each month on time.

When it comes to bad credit loans, the main thing is that lenders need to ensure that you can receive your loan upfront but make payments on time – or they will not get their money back. However, certainly by having a stable and regular employment gives lenders some confidence that you are generating a regular income that can be used to pay off your loan on time.

How Can You Get a Payday Loan with Bad Credit?

1. You need to have a stable income and employment – so money is coming through that can be used to pay off your loan

2. Your credit score is improving over the last few weeks and months, not getting worse i.e you are on the way up, not down

3. The amount you want to borrow may be adjusted – looking to borrow $300? This could be adjusted to $200

4. The rates you are charged are adjusted to reflect the risk – a good credit customer may receive a rate of 30% APR, but a bad credit customer could receive more than 50%+ APR

5. You have paid off other loans on time – this may be the case despite having a bad credit score, but the more you pay off on time, the better.

6. You have a low amount of debt open – it will certainly help if you have just a few normal credit cards, rather than having 3 payday loans open at once and still looking for another loan.

Key Points

- Payday lenders are designed to help people with fair and bad credit – the lenders are prepared to offer products for all histories

- Worse credit scores typically could mean paying higher interest and getting less favorable loan terms

- Borrowers may be vulnerable to predatory lending or paying very high interest rates, so they must be careful

What is Considered To Be Bad Credit?

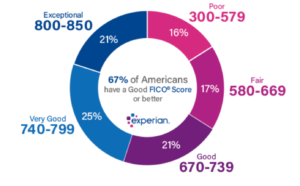

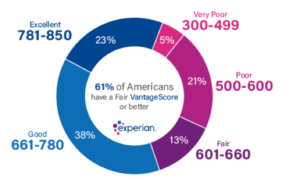

Ranging from 300 to 850, bad credit scores are considered to be below 670 points on FICO or below 661 on VantageScore.

| FICO | VantageScore | |

| Good | 670-850 | 661-850 |

| Fair | 580-669 | 601-660 |

| Bad | 300-579 | 300-600 |

Do Payday Loan Companies Check Your Credit?

Most payday lenders will run a credit check because the loan is unsecured (not secured against anything valuable) and therefore, your credit history is one of the few things they can use to determine your eligibility for a loan product. By running a credit check, the lender can get an idea of how well you have paid similar loans in the past and if you have any major debts outstanding.

For this reason, it certainly helps if you have paid off some other loans, bills or credit cards recently or have been taking measures to improve your score.

If you think that you are going to be declined because of your credit score, you can look at no credit check loans or products that use collateral to help you borrow money.

Is It Easy To Get Approved For a Payday Loan?

Yes and no. A payday loan is not always guaranteed and you will need to be employed, have a stable income and have some positive notes in your credit history to be approved. When compared to other loans such as mortgages or personal loans, you might say that payday loans are possibly easier to get or more available for those with bad credit. You may find that the eligibility and approval rate is similar to credit cards which are based on being unsecured and having similar eligibility criteria.

What Do I Need to Get a Payday Loan With Bad Credit?

In addition to your basic information such as (name, age, DOB, income, employment, bank details), you will need to include:

- A valid form of identification

- Source of income (e.g., paystub)

- A social security number

- Active bank account

- Active email address

By providing this information, you should be able to receive an instant decision or provisional quote on the screen stating that you can “borrow this amount” over this period and at these rates – and if you like the offer you can proceed. The terms of the agreement will be clearly presented to you in an e-document including the amount, repayment terms and responsibilities of you and the lender. If you wish to proceed, you can electronically sign the loan agreement and then your loan will be subject to further checks and can be fully funded and sent to you bank account within 1 hour, 24 hours or next business day – (see also same day loans).

It is possible to take out a payday loan with bad credit but you may also want to consider alternative options.

Should I Get A Payday Loan If I Have Bad Credit? What Are The Alternatives to Payday Loans?

Payday loans are designed to fix unexpected situations or emergencies quickly and they certainly have a place for people with a shortfall and short term need for cash. However, they are not suited as a long term solution to financial debt and those with ongoing financial difficulties.

Before taking out a payday loan, remember that the interest rates charged are above your typical financial product such as a credit card or personal.

Plus, if you are unable to pay the loan back on the due date, you should avoid taking out a payday loan in the first place because the implications of non-repayment can be expensive. Typically you will pay between $15 to $20 for every $100 you borrow and any late payments will incur additional interest and fees and negatively impact your credit score.

If you are looking for some low cost alternatives because you need money until payday, you can consider asking family or friends which often are zero percent interest.

You can consider low costs of credit such as using a 0% credit card during its introductory offer, working with a local credit union, speaking to a debt counselor, selling goods that you no longer need such as clothes, CDs, sports equipment and board games or even borrowing against something such as your car – although you could risk losing this if you cannot repay.