Payday loans are easy-to-access short-term loans that help you cover a shortfall in cash until your next payday. They’re typically in small amounts, such as $100, $200 or $500 and often carry high APR rates because they are used by people for short periods and those with less than perfect credit scores. You’ll typically pay them back on your next payday and a typical loan term is only weeks or months.

What Is A Payday Loan?

Payday loans are slightly different from consumer loans that you might take out. Depending on which state you live in, you’ll be able to get a loan either online, credit union or in-store.

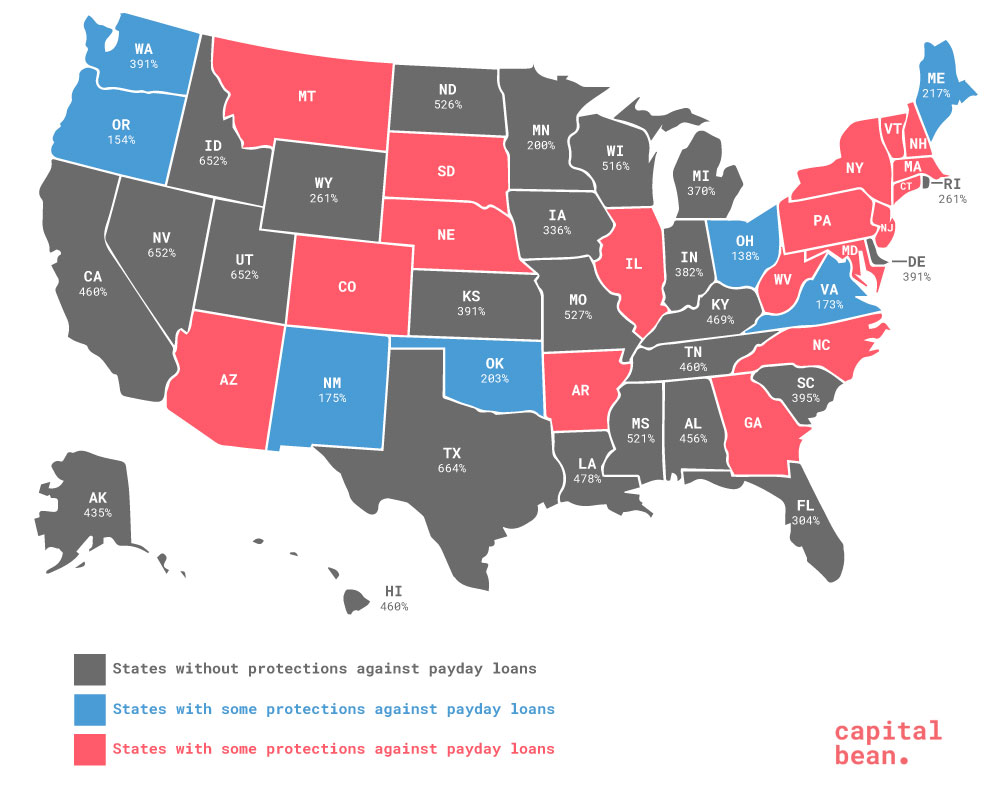

Payday loans are currently legal in 37 different states and depending on where you live will determine how much you can borrow and for how long.

After you’re approved for a payday loan, the money will be in your account the same day next day within 24 hours. Once the money is in your account, you’ll have to repay the full amount after your next payday. You can also pay back in installments if you’re borrowing larger amounts like $1,000 or $2,000.

Because you’re borrowing the money for a short period of time, the APR associated with a payday loan is typically high. In the US it is estimated that 12 million Americans will take out a payday loan in 2022. They’re popular for a number of reasons:

- They’re a great way to access fast money if you don’t have any other options.

- Very bad credit is considered.

- You might ask family and friends as an alternative but might not feel comfortable. Alternatives do exist but might not always be possible to get the money fast.

- Payday loans are typically easy to get and the process is quick.

How Much Can I Borrow With A Payday Loan?

According to the Consumer Financial Protection Bureau (CFPB), the median payday loan is $350 paid back within 14 days. However, payday loans can range from $100 to $1,000 and above depending on where you live and where you get your loan. Loans are currently legal in 37 states. 32 states have a capped maximum. Utah, Wisconsin, Maine, and Wyoming do not have any cap and you can borrow up to $35,000. In Illinois, Idaho, and Delaware have the highest cap of $1,000. Montana and California have the lowest at $300.

They’re also capped based on how much you make each month. In New Mexico and Nevada you cannot borrow more than 25% of your monthly income.

Maximum Payday Loan Amount By State

An easy snapshot to see the total APR rates charged across the US where payday loans are legal.

How Much Does It Cost For A Payday Loan?

The cost of a payday loan differs depending on where you live. Cost range anywhere from $10 to $30 for every $100 borrowed. If you borrow a payday loan for 14 days or 2 weeks, typically costs $15 per $100. That’s 15% interest over this period.

As an example, if you borrow $200 for a 2-week payday loan and your lender is charging you $15 for every $100 borrowed. That interest rate works out at 15% or $30. However, because you have to repay the loan in 14 days, that works out an annual percentage rate of close to 400%. If you’re borrowing across two weeks, the daily interest is $2.14.

If you were to extend that loan for a full year, then borrowing $200 would cost you $782. Before you take out a loan, the lender must tell you what the annual percentage rate (APR) is. 400% APR is typical for payday loans, but in some states, you can get APRs as high as 1,900%. If you compare this to a credit card, the APR on a credit card is typically 12 to 30%.

How Can I Repay A Payday Loan?

Payday loans are named because you typically pay them back before your next payday. You’ll typically pay them back in one payment. When you first sign up for a payday loan make sure to ask the specific due date or look for the date in the agreement that you’ve signed.

Depending on where you live and the lender, you have a couple of options to repay your debt:

- Pay online by direct debit

- Pay by phone using your bank details.

- A check

A backdated check. - Cash

You can set up an ACH authorization so that the money is automatically taken out on the date it’s due. If you do this, make sure that you have the correct amount of money in your bank account on that date.

Many payday lenders cannot repay the money when it’s due and typically roll over the debt to another month. Around 20% of payday borrowers default on the money that they own and 80% rollover or borrow more the next month.

What Is A Payday Loan Rollover?

Depending on the regulations in your state, some lenders will allow you to roll over the loan to the next month. If your loan expires soon and you don’t quite have enough money to pay it, you can roll over part of it to the next month.

This is beneficial because you don’t have to pay late fees on the money that you’ve borrowed and the larger loan balances rolled over to when you can hopefully pay off the full amount.

Does A Payday Loan Affect My Credit?

Payday lenders often work with borrowers with bad or very bad credit and sometimes don’t even do a credit check. Sometimes this won’t show up on your credit score.

However, if you fail to make repayments on your loan or your loan becomes delinquent, then this could show up negatively on your credit history. Once a collection agency buys the delinquent account they could report it to the credit bureaus.

»MORE: How does a payday loan affect my credit

Are Payday Lenders Licensed?

Payday lending is not legal in all states, but in those that are they require them to be licensed. If you make a payday loan as an unlicensed lender, the loan is considered invalid. This means that whoever lent you the money does not have the right to collect the money that they lent to you.

Every state has a different law when it comes to payday loans – right down to whether you can borrow money online today or whether you have to visit a shop front.

Should I Take Out A Payday Loan?

Payday loans are useful if you need urgent cash for unexpected medical bills or other expenses. They are not a solution to long-term debt management and should not be used as such.

The APRs are high because they expect you to pay back the money within 1 to 2 weeks and are not designed to be a long-term lending product. You should think about all your options before you decide to take out a payday loan.

What Are Some Of The Alternatives To Payday Loans?

Payday loans aren’t for everyone- look at the alternatives before deciding whether to take out and payday loan or not.

Loans For Bad Credit

Some online lenders offer loans for those with very bad credit. You might need to borrow money to cover a debt or an emergency medical bill – you can usually get the money that you need from them.

The interest rate charge will be higher than other personal loans because of your bad credit rating but they are typically lower than a payday loan.

» COMPARE: Loans for bad credit

Borrow Money From Family Or Friends

You might be able to cover the shortfall in cash by asking family and friends to borrow some money. This is a good option if you don’t want to take out a payday loan and have someone to ask. Make sure to put in writing how much you’re borrowing and for how long. You don’t want the lending of money to get in the way of a family or friend relationship.

» MORE: Borrow money from family and friends

Credit Cards For Bad Credit

There are credit cards available if you do have poor credit, but they typically involve some sort of deposit or down payment. This is because it’s a riskier product and the default rate is high.

Some issuers do offer unsecured credit cards and you need to shop around for a good deal.

How Do Payday Loans Work?

There are five simple steps to how you can borrow money with a payday loan.

1. Shop Around For Options

Payday loans are not for everyone and before applying for a loan you should look at whether this is the best product for you. It’s not a long-term solution and should only be used over a short period of time.

An alternative to payday loans is a payday alternative loan. You can find PALs through credit unions that are members of the National Credit Union Administration. You could use this product if you want to avoid taking out a payday loan. If you get a lower-cost PAL, it gives you more time to pay off the loan. The payday loan does which is typically due within 2 weeks to a month.

You might also look at borrowing money from your employer or getting a cash advance on your salary. Also, think about family friends as we discussed above.

2. Check If You’re Eligible For A Payday Loan

If you’ve explored the options and you do think that a payday loan is the right option, then need to check whether it’s legal to apply.

Payday loans are legal in 37 states across America and illegal in 13. Payday loans are popular in California, Texas, Mississippi, and New Mexico. It is legal to use payday loans in New York in Massachusetts, however.

Before you apply for a payday loan, you need to make sure you meet the following eligibility criteria.

- You must be a US resident and be over 18 years of age.

- You need to be in stable monthly employment and earn over $800 per month.

- You must have a valid cell phone number so that the lender can get in touch with you if they have any questions.

- You must have a live inactive checking account for the money to be paid into and to make your monthly repayments.

- Determine how much you want to borrow and for what length of time.

Once you’ve met the eligibility criteria, the next step is to determine how much money you want to borrow. You also need to make sure you’re in a state where payday loans are legal and as long as you hit these two criteria then you’re ready to apply.

The average payday loan is around $350 paid back within 2 weeks. Depending on where you live, you could borrow $500, $1,000 or even $2,000 for one month up to 60 months.

The important thing about a payday loan is to only borrow what you need and not help what you want- loans should not be used for casual shopping or for entertainment- they should only be used in emergencies. Make sure you can pay back what you borrowed, otherwise you could get into further financial difficulties.

4. Make Sure You Can Make The Repayments

After you figure out how much you want to borrow and for how long, the lender should let you know how much your monthly repayments are going to be. It is important to be able to repay these repayments and pay for your other bills and expenses in the month. If you miss any repayments, the interest rate could increase getting you into more financial difficulty.

If for any reason you can’t be paid your payday loan, you should let the lender know immediately. If you don’t let them know you could get late fees or increased interest which could make it even more unaffordable.

5. Apply Online

Now that you know that you can apply, how much you want, and that you can make repayments, it’s time to apply online. You can apply online using our 100% free application form and get an instant decision. Capital Bean is a loan connection service and will connect you with the best lender for your needs today.