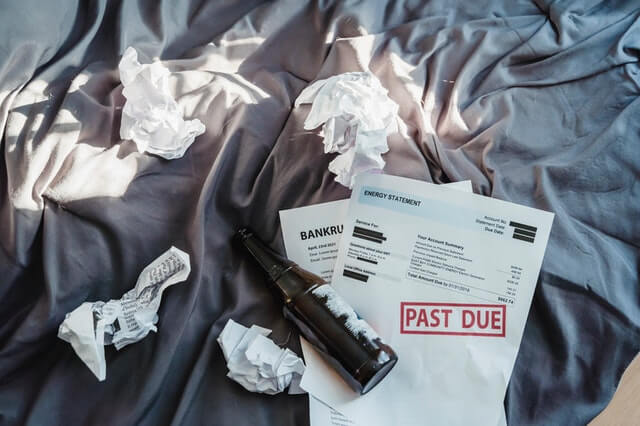

Filing for bankruptcy is a way to eliminate debt and start your financial situation with a clean slate. However, it is a drastic measure that comes with potential risks. Here we explore why you might file for bankruptcy, how to do it, and what are the possible consequences.

Why do people file for bankruptcy?

Filing bankruptcy can help a person to clear their debts or assist them in making a plan to pay off their debts. Bankruptcy cases typically start after the debtor files for bankruptcy via a petition with the bankruptcy court. Petitions can be filed as an individual, jointly as spouses, or as a corporation or other type of entity.

Key Points

- Filing bankruptcy is a way for people to clear their debts or develop a new repayment plan

- There are different types of bankruptcy, all of which are dealt with in federal courts

- Bankruptcy allows individuals to start their credit history from scratch

What types of bankruptcy are there?

All bankruptcy cases are outlined in the United States Bankruptcy Code are dealt with in federal courts. Depending on how you are filing for bankruptcy (i.e. as an individual, as a company etc.), you will use a different Chapter.

- For individuals, they will file either Chapter 7 or Chapter 13, depending on their personal circumstances

- Businesses applying for bankruptcy may file under Chapter 7 if they wish to liquidate or Chapter 11 if their plan is to reorganize

- Municipalities will need to file under Chapter 9 in order to reorganize

Working alongside a lawyer can help you ensure that you are filing for the correct Chapter to suit your circumstances.

Can I apply for bankruptcy?

There is no minimum debt needed to file bankruptcy. If you have any outstanding debt, bankruptcy is a possibility for debt relief. This can include unsecured debts (such as credit card debt, payday loans or medical bills) or even secured debt such as payment for your house or car.

How do you file for bankruptcy?

To have your debts cleared by filing a bankruptcy, you must file Form 103B. This is the Application to Have the Chapter 7 Filing Fee Waived and you will include this when filing for bankruptcy. As part of the form, you will need to certify your income and demonstrate that you are unable to afford to pay installment payments.

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy is a common way of relieving debt in the United States. Those who are riddled with debt can apply for this form of bankruptcy, erase their debts and start their finances from scratch.

This type of bankruptcy will erase the majority of debt types including personal loans, payday loans, credit card debt and outstanding medical bills. When you are granted a bankruptcy discharge from the bankruptcy court, it revokes your obligation to repay these types of unsecured debt.

What benefits are there to filing for bankruptcy?

For those who are in a debt cycle that is impossible to get out of, there are many benefits to filing for bankruptcy.

Long-term debt relief

One of the main reasons that people file for Chapter 7 bankruptcy is that it wipes out the majority of debts. Once the bankruptcy court grants you a bankruptcy discharge, it relieves the obligation for you to pay off unsecured debt including medical bills, personal loans and credit card debt.

Missed monthly payments or any other negative points on your credit report will no longer have an impact on your long-term credit score. As soon as you have filed for bankruptcy, you start to rebuild your credit score from scratch.

As a result of filing bankruptcy, you will also start to receive offers for credit cards, allowing you to start rebuilding your credit and increasing your credit score with a clean slate.

Immediate protection

From the moment that you file for bankruptcy with a bankruptcy court, you will be protected from creditors thanks to the automatic stop that the bankruptcy court places on collection actions. This means that any calls, wage garnishments or other correspondence is immediately stopped. Filing for bankruptcy also has the potential to immediately stop any threats of repossession foreclosures and evictions.

Maintain possession of your belongings

In the vast majority of cases of Chapter 7 bankruptcies (95%), individuals are able to keep all of their belongings, Under US law, certain belongings (what is known as your “exempt property”) wil be protected from creditors. This could be anything from jewelry to your monthly paycheck to your furniture. In some cases, you may even be able to keep your car should you want to.

Filing bankruptcy can be a way of clearing your debt; although, not all existing debt can be cleared.

What are the downsides to filing Chapter 7 bankruptcy?

If you are contemplating bankruptcy as a means of relieving your debt problems, there are certain downsides you may want to consider.

It does not erase all debt

The main downside of Chapter 7 bankruptcy, if you are using it as a solution to clear your debts, is that it does not erase all unsecured debts. Some debts, such as alimony and child support, will never be discharged by filing for bankruptcy. Similarly, student loans or tax debts can be difficult to totally eliminate by filing bankruptcy.

You may not be able to file Chapter 7

If you do not pass the means test, you will not be able to file Chapter 7 bankruptcy. This is possible if you have too much disposable income, for example if you have money in savings after paying off your main living expenses. If this is the case, you cannot simply leave your debt behind. However, you could get a bankruptcy discharge if you opted to complete a Chapter 13 repayment plan instead.

You could lose some property

After getting a bankruptcy discharge, you may need to give up some personal property after a few months. This could be any item of value and not all items, unfortunately, can be classified as exempt property.

Only protects yourself

Filing Chapter 7 bankruptcy will only clear your personal debts. This means that if the debt is owed by another party, your filing will not eliminate their obligation to pay.

Is filing for bankruptcy a guaranteed solution?

Receiving a bankruptcy discharge after filing for bankruptcy is practically 100% guaranteed. In the majority of cases, if you pass the means test, have never filed bankruptcy before and are honest in the information that you are providing to the bankruptcy court, there is no reason why you should not get the bankruptcy discharge. This can sometimes be in as little as 3 months.